Challenge

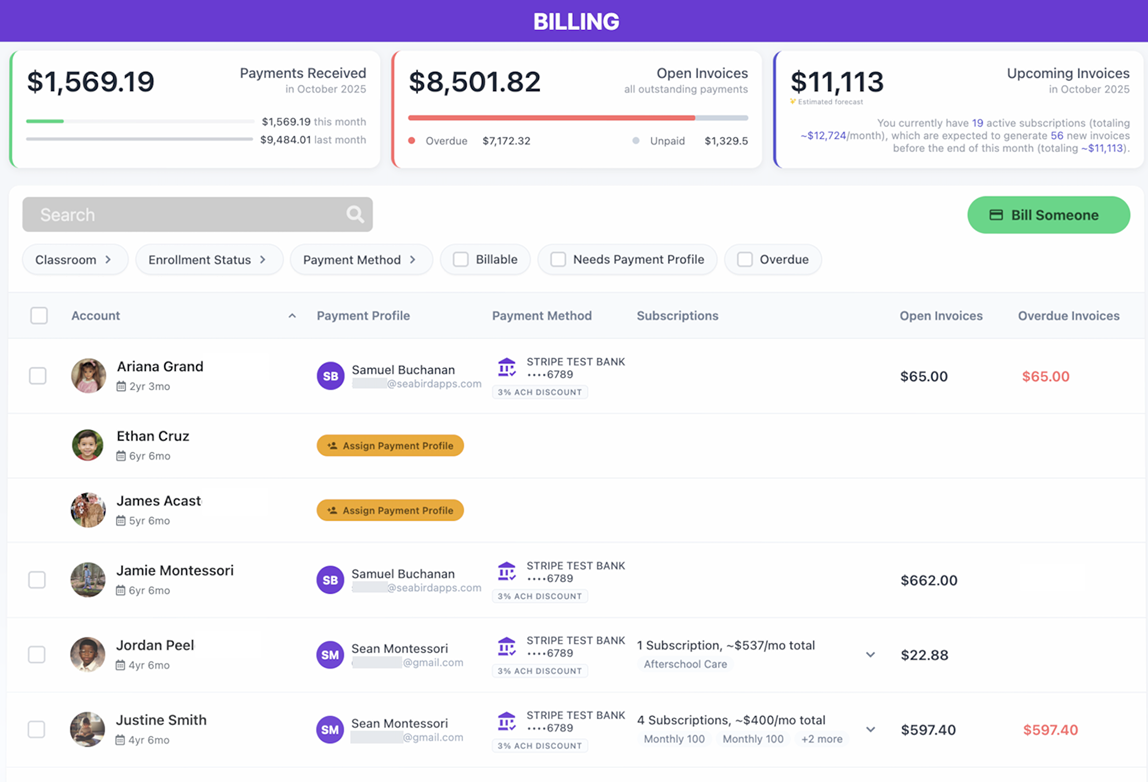

At Montessori and other small, independent schools, a single administrator is often in charge of student records, attendance, parent communications, and tuition collection. To ease the burden on these administrators, Sean Cann and Samuel Buchanan founded Onespot in 2021 to give schools their own app to handle recordkeeping, communication, and billing. The company adopted Stripe Connect in 2024 to allow schools to collect tuition and other payments easily and securely.

As more schools adopted Onespot’s Stripe-powered billing features, the company recognized that there was a persistent pain point: schools had to manually reconcile their payment data in QuickBooks. In March 2025, Onespot decided to automate that process. However, the company determined that building such an integration using the QuickBooks API would take its two-person development team weeks to complete. With the school year quickly approaching and the team wanting to focus on developing other features for the app, spending weeks to integrate with QuickBooks wasn’t feasible.

“We knew this was a big desire for our customers and that we should solve this problem; otherwise, they would continue to be frustrated that their systems weren’t connected,†said Cann.

Solution

Onespot turned to a third-party solution: the QuickBooks Sync app by Acodei. The app is available on the Stripe App Marketplace for Stripe businesses, and it can be embedded directly into platforms using Connect embedded components. With this solution, Onespot created a direct integration between a school’s Stripe data and its QuickBooks account—without a complex development process.

“When we did our due diligence with Stripe and Acodei, they were both the most user-friendly and flexible systems for what we needed,†said Buchanan.

Onespot quickly integrated the solution using Stripe’s Connect.js to add dashboard functionality for its schools. The team then embedded the QuickBooks Sync app with just a few lines of code. Finally, the team configured the app to map payment data in Stripe to the correct accounting objects in QuickBooks Online.

The app auto-syncs all invoices, sales, payouts, refunds, fees, and customer details collected by Stripe—along with check and cash payments not processed by Stripe—giving schools a single, comprehensive record. Because the sync passes data directly between Stripe and QuickBooks, Onespot never handles or stores sensitive accounting data.

Onespot’s QuickBooks Sync integration ensured that schools’ Stripe data maps precisely to QuickBooks without requiring the Onespot team to study the QuickBooks API or navigate complex accounting issues. And if a customer needs support, Onespot can direct them to Acodei.

“Acodei deeply understands QuickBooks and accounting and has been working on this specific function for years. If any of our schools has an issue, I know Acodei can jump in and talk to the school’s accountant to solve the problem much faster than we could,†said Cann.

Results

Onespot integrated QuickBooks Sync in two days

Cann estimated it would take at least a month to build, test, and deploy the integration in-house. With the embedded app, it took two days. Onespot was able to offer QuickBooks Sync long before the beginning of the school year, freeing its two-person development team to focus on other features.

“Ultimately, if we’d had to do it in-house, we probably wouldn’t have done it at all. We were scaling so quickly, and there were so many other high-value features we wanted to build. This let us do it all,†said Cann.

10% of Onespot’s customer base was onboarded in the first 2 months

Within 2 months of launch, 10% of Onespot’s active customer base used QuickBooks Sync to connect their Stripe data to QuickBooks. And Cann believes those customers’ positive experiences are now paving the way for wider adoption.

“We’ve had 1 school that is part of a 70-school network tell us how much they love it already,†said Buchanan. “As they share their experience, we expect to see more schools in that network start using the feature.â€

Schools now save eight hours of manual reconciliation

According to Acodei’s founder, Jeff Ward, schools using this integration can save roughly a day in manual reconciliation during tax time.

“I built this integration out of my own frustration spending hours and hours trying to reconcile my Stripe transactions in QuickBooks. Users can now stay on top of reconciliation with a few clicks a month, saving at least eight hours or so in work,†said Ward.

With Stripe and Acodei, we’re empowering schools with the same world-class payment and accounting technology that the largest companies in the world rely on. It’s game-changing for them. It’s been amazing to be able to launch really powerful tools with top-tier support with our lean team.

About Acodei

Trusted by more than 10,000 businesses, Acodei builds accounting automation tools that help businesses sync Stripe payment data with QuickBooks.

Acodei’s embedded app enables platforms to save time and money in building out a QuickBooks integration, and connected merchants get penny-perfect accounting records come tax time. It’s a win-win for platforms and users.